Barcelona, February 4, 2025.-

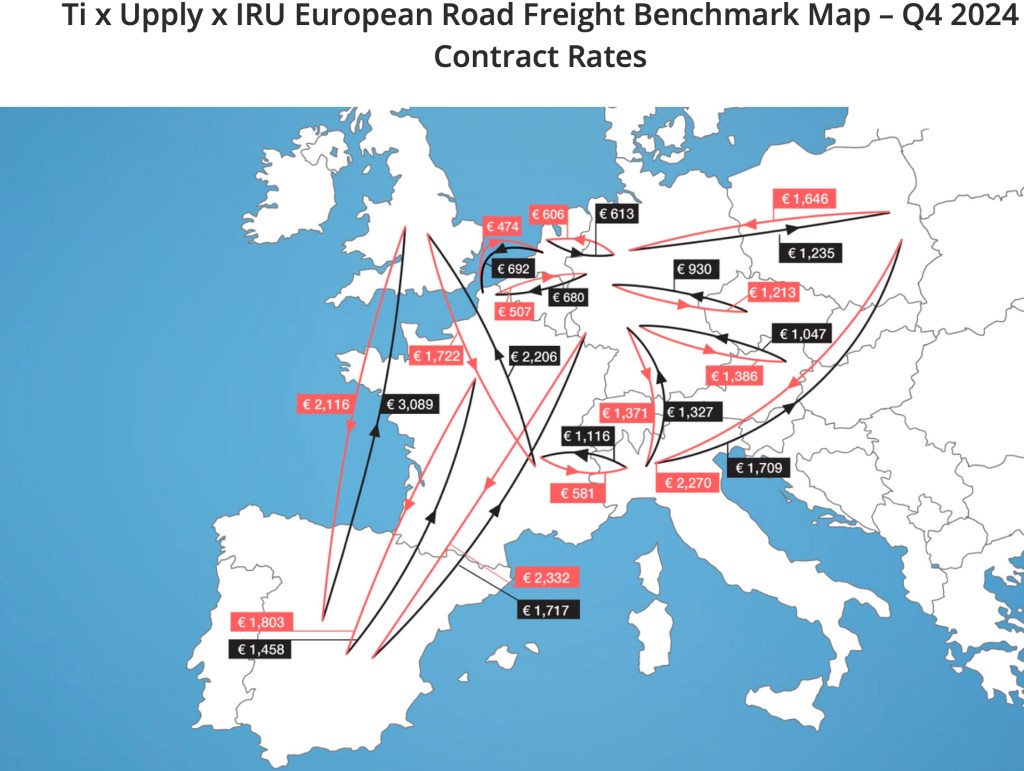

- Contract rates increased by 2.8 points to 128.9, while spot rates remained stable at 123.9.

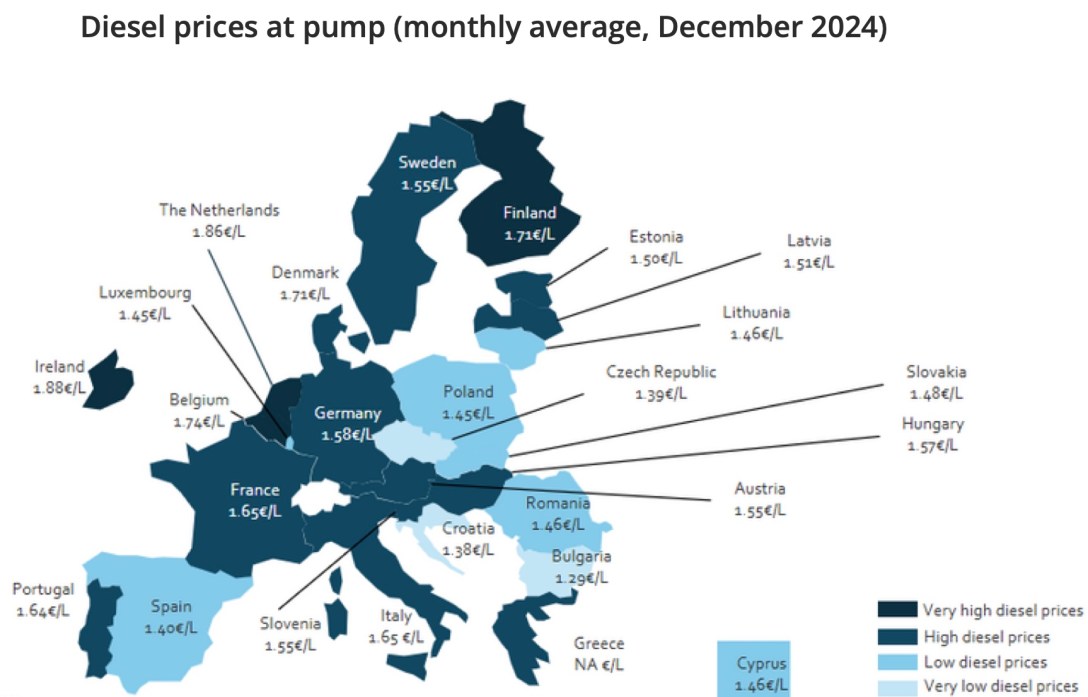

- Labour shortages (500,000 vacancies) and rising wages (+5% YoY) are pushing costs higher, despite a 11.7% drop in diesel prices.

- Nearshoring to Poland, Romania, and Türkiye is shifting transport demand.

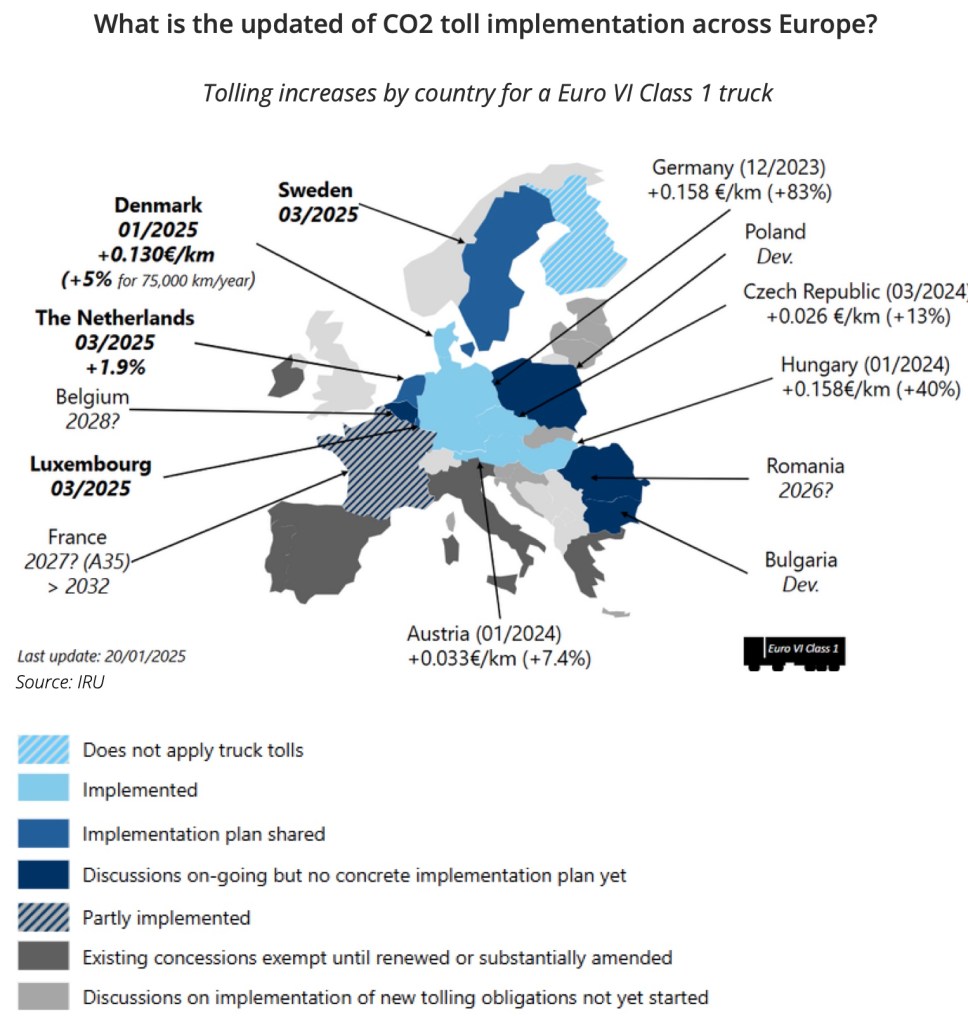

- EU regulations (Eurovignette Directive, ETS2) will increase costs and pressure margins.

Regional Insights

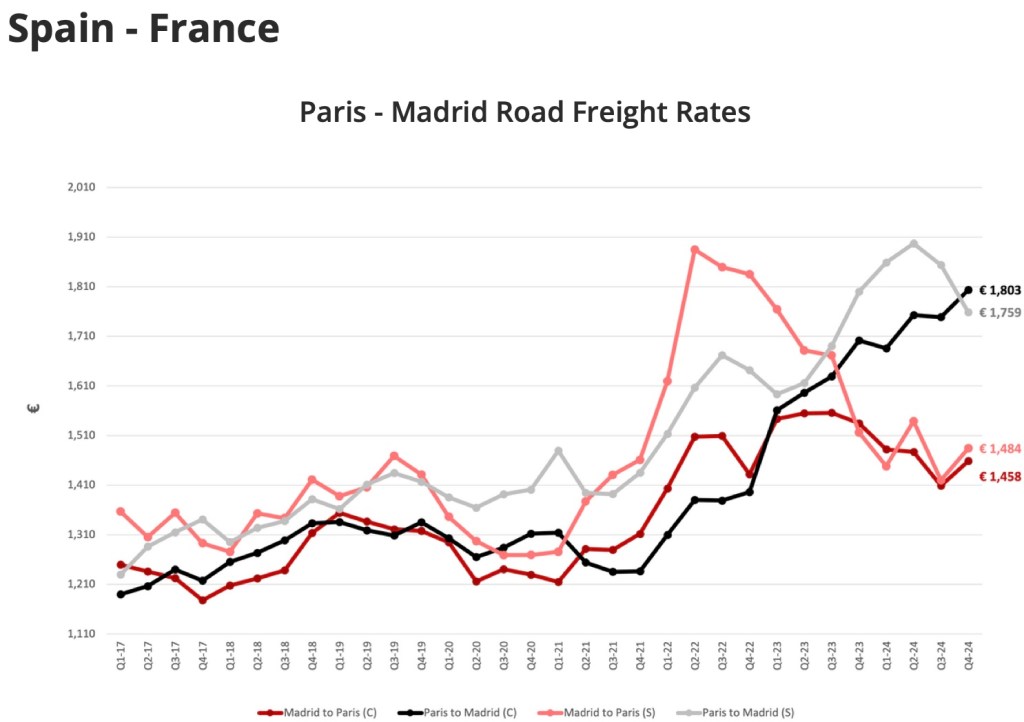

Spain – France

📌 Madrid to Paris

- Contract rates +3.5% QoQ, spot rates +4.5% QoQ.

- Spanish retail demand slowed (-1.4% YoY), but manufacturing remains strong.

📌 Paris to Madrid

- Contract rates +3.1% QoQ, but spot rates fell 5.1% due to lower vehicle exports (-18.1% YoY).

Germany – Poland

📌 Warsaw to Duisburg

- Contract rates +2.3%, spot rates +3.3% QoQ.

- MAUT toll increases & CO2 surcharges are raising transport costs.

- Polish labour costs +16% YoY, 2nd highest in the EU.

France – UK

📌 UK to France

- Contract rates -8.2% QoQ, reflecting weak trade (-6.6% UK exports to France YoY).

- Diesel costs fell (-11.2% France, -9.8% UK), easing pressure on rates.

Italy Domestic Market

📌 Italy

- Contract rates +3.9 points, spot rates -10.0 points in December.

- Vehicle production below 500,000 in 2024 (-33% YoY), impacting freight demand.

✅ Cost Increases: CO2 pricing, labour shortages, toll hikes will pressure profit margins.

✅ Nearshoring Growth: Poland, Romania, Türkiye emerging as key logistics hubs.

✅ Consumer Demand Recovery: Expected to gradually support rate growth in H2 2025.

2025 Outlook & Strategic Considerations

More Information: Full Report